NEWS

Incubate Camp, a Seed Acceleration Program, where time spent in earnest leads to results unclassified

Incubate Camp was created in 2010 as an interface between entrepreneurs and investors. The camp has achieved steady results as a place for startups to grow.

We asked Keisuke Wada, the founder and representative partner of Incubate Camp, about the seed acceleration program, Incubate Camp, which is the most important program of Incubate Fund, whose motto is "to support the challenges of aspiring entrepreneurs.

Incubate Camp" is increasing its value as the hurdles to entrepreneurship are lowered.

--Incubate Camp has grown to become the "face" of the Incubate Fund, with many success stories already.

Wada: When Incubate Camp started, I don't remember there being that much demand for seed investment.

To briefly explain the historical background, the smartphone shift progressed rapidly from around 2010 when we started the camp. The trend of the rise of social games came, and the hurdle for starting a business was lowered considerably. In addition, there were companies like DeNA and GREE that grew from venture companies and went public.

At the same time as the start of the camp, both entrepreneurs and investors were beginning to target the next DeNA and GREE. In the midst of these changes, there was a need from the investment side to invest more quickly.

Globally, there were already various types of accelerators and incubators, but I think they became visible in Japan in 2010, when we started the camp, and that's when Open Network Lab and Samurai Venture Summit started. That's right.

A "camp-type" program for entrepreneurs and investors to meet each other

--One of Incubate Camp's greatest features is its format. Why did you choose the camp format?

Wada: Incubate Camp is held in the form of a camp for two days and one night. It's really a camp, but this format is certainly a unique feature. The reason we made it a camp is that we wanted to create a place where entrepreneurs and investors could get to know each other seriously, rather than just making contacts or showing off.

--What is the camp schedule like?

Wada: On the first day of the camp, entrepreneurs give a presentation about their business plan. After that, the entrepreneurs and investors do a round of mentoring and pair up based on the feeling they get at that time.

Matching is done by investors voting for the entrepreneurs they want to pair up with. Entrepreneurs that more than one investor wants to pair up with can choose their partner, so investors can be rejected.

--and from there, you work together to brush up your presentation.

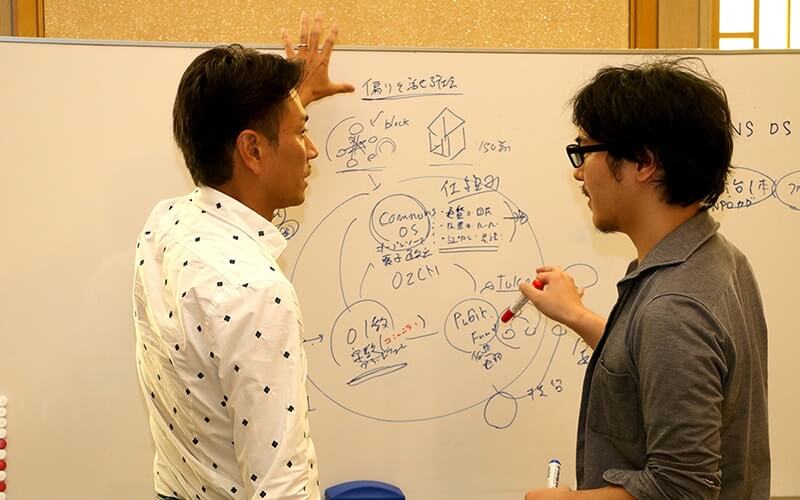

Wada: Discussions start for the presentations on the second day. It's a serious competition between entrepreneurs and investors. Investors point out details and numbers as well as the direction of the business in detail, and work with the entrepreneur to come up with ideas to overcome them. They work together with the entrepreneur to come up with ideas on how to overcome these problems. They revise the strategy, revise the presentation, and work out how to get the investor to invest in the business.

Serious competition that will test not only entrepreneurs but also investors

--Isn't this a place where investors can make one-sided suggestions to entrepreneurs?

Wada: Entrepreneurs and investors who are paired together face each other thoroughly. It's not unusual for discussions to extend late into the night.

It's not uncommon for a business that had a lot of issues in its presentation on the first day to outperform the other businesses in its presentation on the second day after the mentoring discussion, so even though it's only one night, the participating entrepreneurs' businesses grow at a very fast pace. At the end of the camp, there is an event where entrepreneurs vote on which investor's mentoring was the best, so the investors are very serious.

--so investors are being tested, too.

Wada: Yes, at Incubate Camp, we screen the applicants based on criteria that will ultimately lead directly to funding. There are many cases where investors who have been involved in Incubate Camp actually invest or help with fundraising, so we put a lot of effort into mentoring. In simple mentoring, we point out shortcomings or give advice like, "If you try this, you might have potential. But at Incubate Camp, the investors are not the ones who talk, they talk, they think, they work, and they sweat. When you look at the faces of the investors on the second day after the mentoring, you can see that they are not simulating, but actually supporting the investment.

Strengthened connections and ties between entrepreneurs and investors

--Incubate Camp is now in its tenth year, and you mentioned that the number of entrepreneurs has increased, but is there anything that has changed over the years?

Wada: I feel that we have grown steadily with the times, but I don't think we would be in the situation we are in now if only Incubate Fund or Incubate Camp had worked hard.

It is said that the VC industry has strong horizontal ties, but if you look at the camp, it is made up of many different people who cooperate with each other. Not only investors, but also entrepreneurs have been brought into the circle. The ties between investors and entrepreneurs have become stronger. The biggest change is that we have more friends.

--Finally, what attracted you to Incubate Camp and how do you plan to proceed?

Wada: I think the biggest attraction of Incubate Camp is the amount of heat that both entrepreneurs and investors generate at the camp. The results of that enthusiasm are steadily showing up in the results. The amount of money invested per investment triggered by the camp has been steadily increasing. The sense of scale is expanding to the extent that we can cover investments in businesses that have already proven themselves, not to mention seed businesses. I feel that the value of Camp has been increasing. I'd like to continue to grow Incubate Camp as a place where entrepreneurs and investors can meet.